Tesla’s $800 Billion Meltdown: Market Value Evaporates Overnight, Triggering ‘Red Alert’ Panic

Tesla is in an unprecedented predicament, but CEO Elon Musk is indifferent to his brainchild.

Like many other American manufacturers, Tesla is in a difficult position because of the trade war initiated by President Donald Trump.

However, unlike most other companies, Tesla has another “side problem” – that is, the close relationship between CEO Elon Musk and Mr. Trump, so much so that Musk is sometimes jokingly referred to as the president’s “No. 1 best friend”.

This week, Tesla will release its financial results and Elon Musk will have a session to answer questions from investors. But it’s not simple – Musk is facing a dilemma: If Tesla continues to maintain a close relationship with Trump, Tesla could turn away many potential customers at home and abroad who don’t support Trump’s policies. On the contrary, if Musk actively creates a distance from Mr. Trump, the risk of being “pinned” by the White House is great.

This is a stalemate that Musk himself has put himself into.

The first quarter recorded the largest decline in Tesla’s sales, after a long period of almost continuous double-digit growth. But financial problems are only a small part of what investors want to know.

Investors will be particularly interested in how much the 25% import tariff imposed by the Trump administration on all imported vehicles is causing Tesla damage, and what Elon Musk thinks about this policy.

Another big question is when Musk will step down from his role at the “Department of Government Efficiency” (DOGE) in Washington to focus on dealing with the problems that still exist at Tesla.

Investors are waiting for concrete advances in projects such as self-driving cars, a fleet of Robotaxis, a new cheaper Tesla model and plans to commercialize humanoid robots.

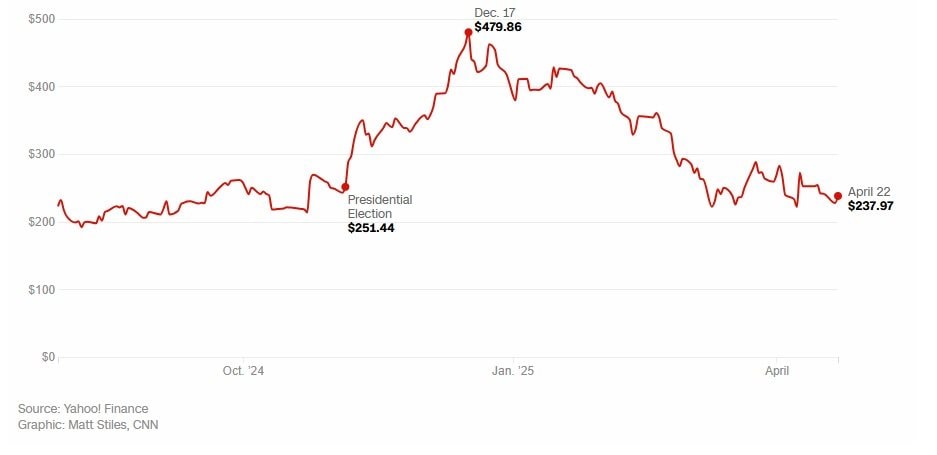

If Musk can offer reassuring answers on any of these issues, it could help reverse the decline that has caused Tesla’s stock price to lose half of its value since mid-December — and partly restore confidence in the company.

Dan Ives, an analyst at Wedbush Securities who has long supported Tesla but has recently aggressively lowered its stock price target, said Musk faces a “red alert” situation if he continues to play a prominent role in the Trump administration.

Citing the affected brand image as the cause of the decline in sales, Ives wrote in a note to customers on Sunday that: “Musk needs to step down from the government, relinquish his role at DOGE, and return to being Tesla’s full-time CEO.”

In addition to the wave of protests surrounding Musk personally, Tesla is also facing increasingly fierce competition from other electric car companies, especially in the Chinese market. Any bad news in these areas could drag the stock price down once again.

“Everything has turned into a nightmare for Tesla and investors,” Ives told CNN. “Tariffs, DOGE controversy, brand damage — literally a perfect storm.”

DILEMMA

In some respects, Tesla is less affected by Trump’s car tax policy than other automakers. The company does not import cars from two overseas plants, and Tesla’s cars made in the United States also use fewer foreign components than its competitors. Meanwhile, most major car manufacturers have at least some imported car models sold at dealerships in the US.

Tesla has stopped taking new orders in China for two high-end models, the Model S and Model X — which are made in California — due to China’s retaliatory tariffs of up to 125%. However, these two models only account for a small proportion of Tesla’s total global sales.

However, Musk once affirmed that the cost that Tesla had to bear was “not small”.

“It should be noted that Tesla is NOT immune in this situation. The impact of the tariffs on Tesla is still significant,” he wrote on social media X, just a day after Trump’s plan to tax cars was announced.

However, if Musk criticizes the tax policy too harshly at the upcoming investor meeting, Musk may damage the “friendly” relationship that is very close to Mr. Trump. Musk became Trump’s biggest financial donor last year, and since his inauguration, he has also been one of the president’s closest advisers.

Tesla shares have nearly doubled in value within two months of the election, as some investors and analysts expect that Elon Musk will have influence over President Trump in promoting policies that are favorable to Tesla — especially in the field of self-driving cars.

However, Trump’s strong support for tariff policies could anger the Chinese government and its consumers. China is currently the world’s largest car market, as well as the largest electric vehicle market.

But consumers here are increasingly turning to domestic rivals, typically BYD. In 2024, Tesla will achieve revenue of $20.9 billion in China, accounting for about 21% of total revenue – the company’s second-largest market, after the US.

Dan Ives said that China is “the key to Tesla’s future success or failure”. He warned that: “The backlash from China to Trump’s tax policy and Musk’s connection will have a serious impact – not to be taken lightly.”

When will Musk leave DOGE?

Protests outside Tesla’s showroom and vandalism at some of its facilities are showing the negative reaction the company and its CEO are facing. Some of the most common questions from investors on Tesla’s website also revolve around this issue.

A question supported by more than 1,000 investors wrote:

“Will Tesla record any significant changes in order rates in the first quarter due to rumors surrounding the brand being compromised?”

Another question, also agreed by many people:

“How does the company plan to deal with the impact of Elon’s partnership with the current administration?”

And another more straightforward question:

“Boycotts, protests, vandalism, negative headlines, and plunging stock prices all stem from Elon Musk’s involvement in changes related to the U.S. government’s public service and human resources. Is Tesla’s Board of Directors considering letting its CEO devote himself wholeheartedly to Tesla and to politics for his elected people?”

Last month, when Elon Musk held an all-staff meeting at Tesla, the event helped the company’s stock recover within a week after a period of being crushed. However, this recovery quickly ended. Overall, since the beginning of the year, Tesla’s capitalization has evaporated by about $800 billion.

On April 2, when Tesla released its quarterly sales report with the largest year-on-year decline ever, its shares plunged sharply until Politico published the news that Musk was about to give up his role in the government. This information immediately pulled the stock price up again. However, Musk and many members of the administration have denied this information, claiming the article is inaccurate.

JPMorgan Chase analyst Ryan Brinkman wrote in a client newsletter earlier this month:

“Tesla’s first-quarter sales and output report leads us to think — if anything — then we may have underestimated the level of consumer response.”

Tesla did not make any comment when asked for feedback on sales or the impact of Elon Musk’s political role on the business situation.

PROMISE MORE, DO LESS

Musk has made very bold commitments: Building a fleet of self-driving robotaxis and developing humanoid robots, claiming that these will be the factors that will help Tesla become the most valuable company in the world.

He also announced plans to launch an autonomous ride-hailing service in Austin, Texas in June. However, so far, there has not been any update regarding this plan.

Meanwhile, Uber and Waymo (Google’s autonomous car unit) are one step ahead when deploying a hybrid self-driving taxi service in the city itself.

Dan Ives said: “If Musk continues to delay the robotaxi plan, it will be a big blow to the stock. We need to hear positive news in this segment, because nothing will be bright if we look at profits or the financial outlook for the rest of the year.”

Source: CNN

News

Tragic Revelation: Hulk Hogan’s Shocking Cause of Death Uncovered Just Days After His Passing at 71 – The Truth Will Leave You Breathless!

The WWE star died on July 24 in Clearwater, Florida Hulk Hogan on “Good Morning America” on Aug. 28, 2015.Credit…

Miranda Lambert’s Onstage Surprise: A Shocking Wardrobe Malfunction Leaves Fans Gasping – Can You Believe the Breeze She Felt?

Miranda Lambert cheeky wardrobe malfunction is going viral. A fan caught the country songstress’ backside peeking out of her itty-bitty…

The Night CBS Tried to Erase Colbert—And the One Call That Turned the Network on Its Head

**I. The Disappearance That Wasn’t Supposed to Make Noise* It happened without warning, without fanfare, and—most shocking of all—without a…

When a City Refuses to Mourn: Birmingham Turns a Funeral into Rock’s Wildest Homecoming

When a City Refuses to Mourn: Birmingham Turns a Funeral into Rock’s Wildest Homecoming—As Ozzy Osbourne’s Final Procession Brings Tens…

Ozzy Osbourne’s family is laying the legendary rock star to rest, with a funeral procession moving through the streets of Osbourne’s hometown of Birmingham on July 30.

Ozzy Osbourne’s Family Says Final Goodbye to Legendary Rocker in Emotional Funeral Procession The Prince of Darkness, who died on…

A War of Laughter: Late-Night’s Biggest Names Turn on CBS as Colbert’s Fall Sparks Comedy Uprising

**In an era when late-night TV is supposed to be dying, it just became the hottest battlefield in…

End of content

No more pages to load